Thank you for partnering with us to make a positive impact in Central Florida! As the community foundation for Catholic donors, we are blessed to help individuals and organizations engage in philanthropy in a faith-filled way through socially screened investment options and tax-advantaged charitable tools. Our donors’ generosity provides parishes, schools, and diocesan ministries the ability to offer faith-formation experiences for children and adults and necessary renovations and expansions of churches and community centers. Additionally, these charitable resources foster Catholic School education, prepare seminarians for the priesthood, care for retired priests and support nonprofit organizations aligned with Catholic social values in providing healthcare, housing, and food assistance in the nine counties of the Diocese of Orlando.

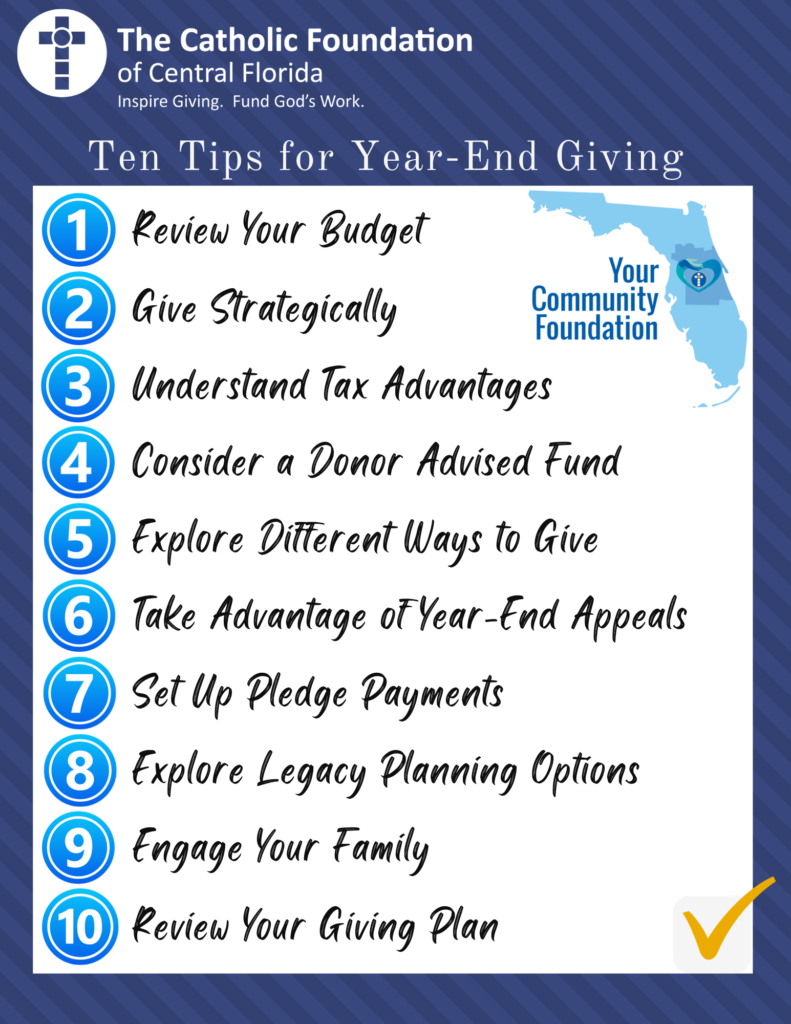

The Catholic Foundation of Central Florida is committed to connecting you with the causes on your heart and providing opportunities to maximize the impact of your charitable giving. The holiday season is a wonderful time of reflection, gratitude, and celebration of Christ’s call to loving generosity. Here are Ten Tips to navigate the giving season in a strategic way:

1. Review Your Budget:

Prayerfully review your financial situation and determine how much you can give to charitable causes. Every gift, regardless of size, can make an impact! If you are a financial advisor assisting clients with budgeting for charitable impact, we have an Advisor Resource Center with tools to assist you in engaging with your clients through a philanthropic conversation.

2. Give Strategically: Plan your giving strategically by focusing on causes or organizations that have a direct and meaningful impact on the issues you care about most. On our Make an Impact webpage, we have organized a list of all the diocesan parishes, schools and ministries on one page for you to discover the many opportunities to support locally based organization. Through our Donor Advised Fund program, we also offer a list of Catholic-compliant nonprofits who operate in accordance with our Catholic values.

3. Understand Tax Advantages: Familiarize yourself with the tax benefits of charitable giving. In many cases, there are opportunities to reduce your taxable income through gifts of appreciated stock, IRA qualified charitable distributions, or bundling giving into a donor advised fund. Consult a tax advisor for specific details. If you are looking for a Catholic advisor, consider a member of our Planned Giving Advisory Council – a group of vetted Catholic professionals committed to assisting you in achieving your financial and charitable goals. Many offer a FREE one-hour consultation to those referred by The Catholic Foundation!

4. Consider a Donor Advised Fund: Consider establishing a donor advised fund (DAF), a hassle-free “charitable savings account” which allows you to make charitable contributions and recommend grants to nonprofits over time. A DAF provides the opportunity to bundle your donations in a single year to maximize your charitable deductions while giving you the flexibility to grant those dollars out to a variety of nonprofits over a number of years. The Catholic Foundation offers a Catholic-compliant Donor Advised Fund Program in which you can grow and give your dollars in accordance with your Catholic values!

5. Explore Different Ways to Give: Explore the numerous ways to give such as appreciated assets like stock or real estate and qualified charitable distributions (QCD) from your IRA which can provide tax benefits. Consider a “Charitable Swap” which offers two tax benefits. First, you can donate appreciated assets that have been owned for a year or more, which avoids capital gains tax and provides a charitable deduction for the fair market value. Then use cash to buy the stock back immediately to maintain your existing portfolio with basis reset to the new price. The Catholic Foundation provides a one-stop shop to assist donors with maximizing their impact through processing of complex and split giving of non-cash assets (appreciated stock, IRA QCDs, cryptocurrency, property, etc.), planned and legacy giving and donor advised fund giving for any parish, school, or ministry in the Diocese of Orlando. Our philanthropic advisory and processing services are complimentary!

6. Take Advantage of Year-End Appeals: Catholic and Catholic-compliant organizations utilize year-end appeals like Giving Tuesday to engage their donors. Many organizations reach out to donors with special campaigns or matching opportunities that can double or triple the impact of your donation.

7. Set Up Pledge Payments: If you are looking to make a transformational gift, but you are unable to make a large donation in a single payment, consider pledging to contribute over a period of time, spreading your giving throughout the year or across multiple years. You can contact one of our philanthropic advisors to explore all the options available to achieve your philanthropic goals.

8. Explore Legacy Planning: To leave a legacy is to reveal our hearts, for our legacy is a final testament of who we are, what we value, and whom we love. Regardless of your age, circumstances, or economic status, we encourage you to begin thinking about the legacy you are creating with your life, your aspirations for what you wish to leave behind, and the message you hope to share with your loved ones, your community, and your Church. One tax smart strategy is to leave part of retirement assets (IRA, 401k, 403b) to a nonprofit. Your heirs will pay income tax on these inherited assets, while nonprofits do not! So consider these accounts for your charitable legacy. The Catholic Foundation has a variety of resources to help you plan for your family and explore the possibility of including a charitable bequest in your estate planning, leaving a lasting legacy for the causes you support.

9. Engage Your Family: Involve your family in charitable giving decisions to teach the importance of philanthropy and giving back while passing on your values. Our Create a Family Mission Statement Guide is a fun activity to start the conversation during a Thanksgiving or Christmas family gathering.

10. Review Your Giving Plan: Make charitable giving a year-round practice and regularly review your giving strategy to ensure it aligns with your evolving goals and values. The Catholic Foundation’s professional staff is blessed to support individuals and families with achieving their philanthropic goals of impacting lives through their charitable giving in the diocese and broader community. Remember that charitable giving is a personal and spiritual experience. Your philanthropy is a wonderful expression of your own values and your loving response to Christ’s call for charity. If you would like to discuss how to best support the causes on your heart through your giving, The Catholic Foundation is here to help!