The Everlasting Fund: An Endowment Funds

A Quick Way to Make a Difference, Forever

“Whoever sows sparingly will also reap sparingly, and whoever sows bountifully will also reap bountifully.”

– 2 Corinthians 9:6

The Everlasting Fund allows you to:

- Provide charitable dollars that continue to grow year after year.

- Offer dependable, permanent support for the ministries you love.

- Preserve what matters most to you for generations to come.

- Create positive change through Catholic-compliant investments.

- This fund can be created during your lifetime or established through a gift in your estate plan.

How Does an Everlasting Fund Work?

- A gift of $20,000 or more will establish your Everlasting Fund.

- This initial amount is invested for growth in a Catholic-compliant portfolio.

- Each year, a percentage of the fund’s value, guided by our spending policy, is distributed to your designated ministry.

- This process repeats annually, and with positive investment returns, your fund has the potential to grow allowing charitable distributions to increase over time.

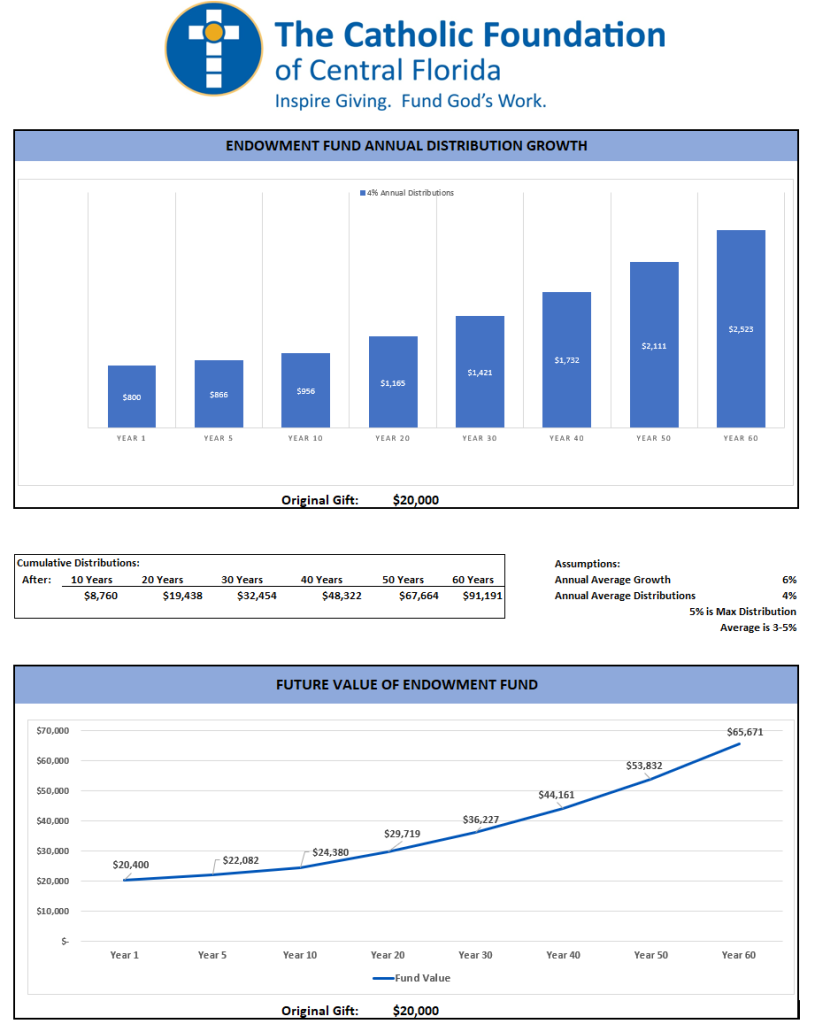

The Power of Your Gift Over Time

Example of an Everlasting Fund Established with an Original Gift of $20,000:

The Everlasting Fund Is for Everyone

- It doesn’t take great wealth to make a lasting difference.

- You can contribute assets in lieu of cash.

- Estate planning costs nothing through basic beneficiary designations. (Basic beneficiary designations can eliminate the costs associated with Estate planning)

- Charitable gifts can reduce your income taxes, capital gains taxes, and even estate taxes.

Ways to Create Your Everlasting Fund

“Entrust your works to the LORD, and your plans will succeed.”

– Proverbs 16:3

Give Over Time

Build your Everlasting Fund gradually through recurring contributions at a pace that aligns with your budget and your giving goals.

Include a Gift in Your Will

You can make a big impact tomorrow without giving anything today. By including a gift in your will or naming a ministry as a beneficiary, you help your faith live on for future generations.

Give as a Group

Families, parishes, or communities can come together to create an Everlasting Fund together, minimizing individual commitment while multiplying collective impact. It is also a powerful way to honor or memorialize a cherished priest, teacher, or loved one – ensuring their legacy continues through the ministries and causes they loved.

Examples of Everlasting Fund name structures:

- The John Smith Endowment Fund

- The Smith Family Endowment Fund

- The Mary Smith Memorial Endowment Fund

- The St. Mary School Endowment Fund for Student Support

- The St. Mary Women’s Guild Endowment Fund

What Can You Use to Fund Your Everlasting Fund?

- Cash – May be eligible for charitable tax deductions.

- Stock – May be eligible for double tax savings: no capital gains tax and charitable tax deduction.

- Donor Advised Fund Grant – dollars already restricted for charitable purposes.

- IRA Qualified Charitable Distribution – Donors 70 ½ or older qualify to give $111,000 per year.

- Bequest – A gift in your will or trust

- Beneficiary designation (i.e. IRA, Annuity, Life Insurance Policy, etc.)

Not Sure What to Do With These Assets?

An Everlasting Fund can be established with more than just cash:

• Real estate (even vacation homes)

• Life insurance policies

• Investment accounts

• Retirement funds

Click Here for Endowment Funds List

Create Your Everlasting Fund Today

Contact one of our Charitable Giving Advisors today to start your fund and experience the joy of watching your dollars grow as it transforms lives and creates lasting impact on the ministry you love.

Contact Us

Individuals, families, or groups looking to establish a new fund or build an existing fund please contact:

Madelyn Weed, CFRE, CAP®

President & CEO

Email | (407) 246-7188

Parish/School/Diocesan Organizations looking to establish a new fund or information on an existing fund please contact:

Nia Herald

Vice President, Chief Financial Officer

Email | (407) 246-7189

Popular Endowment Funding Options

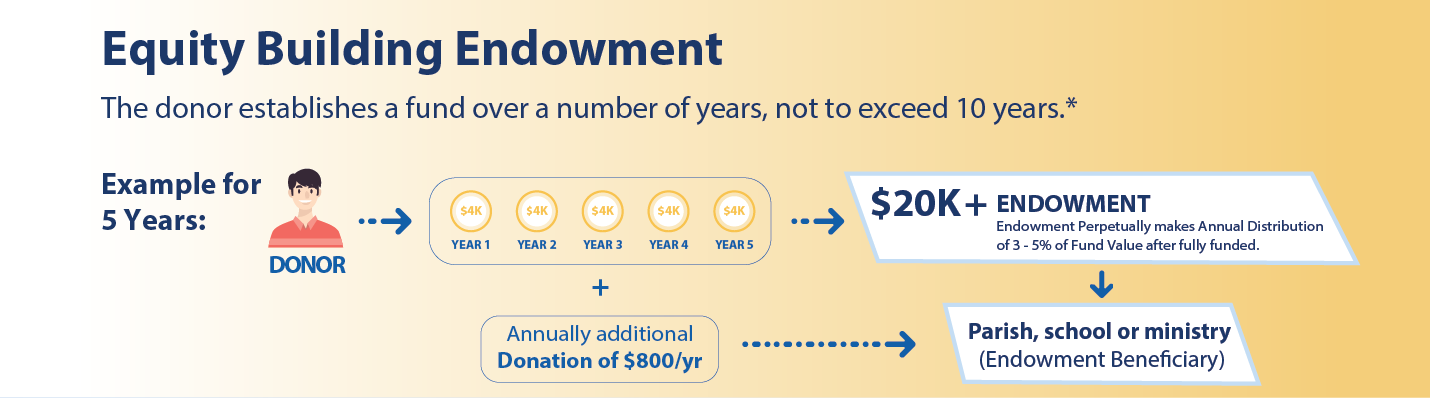

Equity Building Endowments allow a donor to establish an endowment within a certain number of years – not to exceed 10 years. A donor makes an initial gift with an agreement for the balance to be paid annually over a certain number of years (up to 10) and the distribution amount for the beneficiary until the endowment is fully funded. For example, for a 5-year equity building endowment, a donor provides a $4,000 initial gift and agrees to make 4 more annual payments of $4,000 to create the $20,000 minimum endowment. The annual distribution of $800 – would also be in the agreement for the donor to provide to the beneficiary through the Foundation for the 5 years. In this type of arrangement the donor provides $4,800 annually for five years to build equity in the endowment and provide the beneficiary annual revenue. After the 5 years, the endowment is fully funded and the endowment will provide future income for the beneficiary.

Virtual Endowments allow the donor to establish an endowment while living which will be fully funded through a bequest. A donor makes an initial gift and provides notification of a future bequest to The Catholic Foundation to establish the Fund. They also agree to donate an annual gift that would equate to the expected annual distribution (or grant) a fully funded endowment would have provided to the parish, school or ministry. For example, a donor might provide a $5,000 gift of stock and a bequest for $15,000 which would create the minimum fund at the time of their passing. The annual distribution from that Fund would be about $800 (based on a 4% average distribution) — so the donor would also be agreeing to provide $800 annually for life through the Foundation for the beneficiary. In these types of endowment arrangements, the donor provides the minimum annual distribution even before the fund is established.

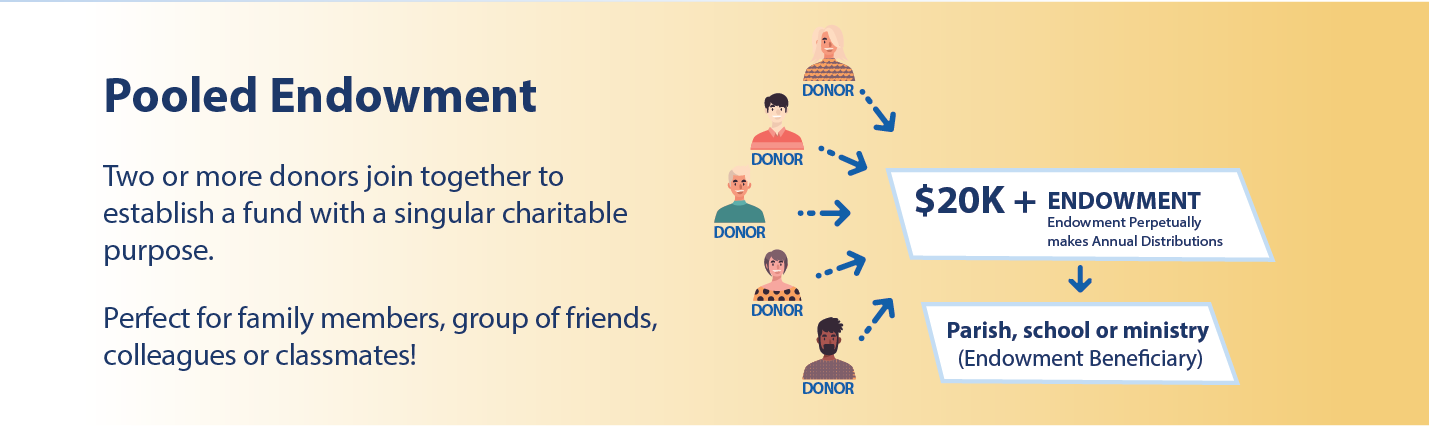

Pooled Endowments allow for a group of people to join together to build an Endowment Fund. This is a good opportunity for an Endowment that will be named in memory of a loved one or in honor of a graduating class or a retiring staff member. The minimum funding level is $20,000, but the initial donations can come from two, ten or even a hundred different donors. Usually, the beneficiary or a family member is designated as the main point of contact for a Pooled Endowment.

If you are interested in learning more about how you can create an Endowment Fund, start by contacting us to discuss your philanthropic or legacy planning goals. We will work directly with you and your financial advisor(s) to customize a plan that will help you make a significant impact on the ministry close to your heart (and provide significant tax advantages.) Once you complete and sign your Fund Agreement, you will have access to a 24/7 Fundholder Portal through which you can keep track of your Endowment Fund and distributions made from it.